Luxury: the decline of multibrand e-tailers

Physical stores have never been as buoyant as now. After the end of the pandemic, luxury consumers have eagerly embraced in-person shopping again, to the detriment of online purchases and especially of multi-brand e-tailers, currently in free fall. Luxury e-tailers have been jettisoned by labels too, and their evident decline, more or less pronounced depending on the individual case, is due to a variety of reasons.

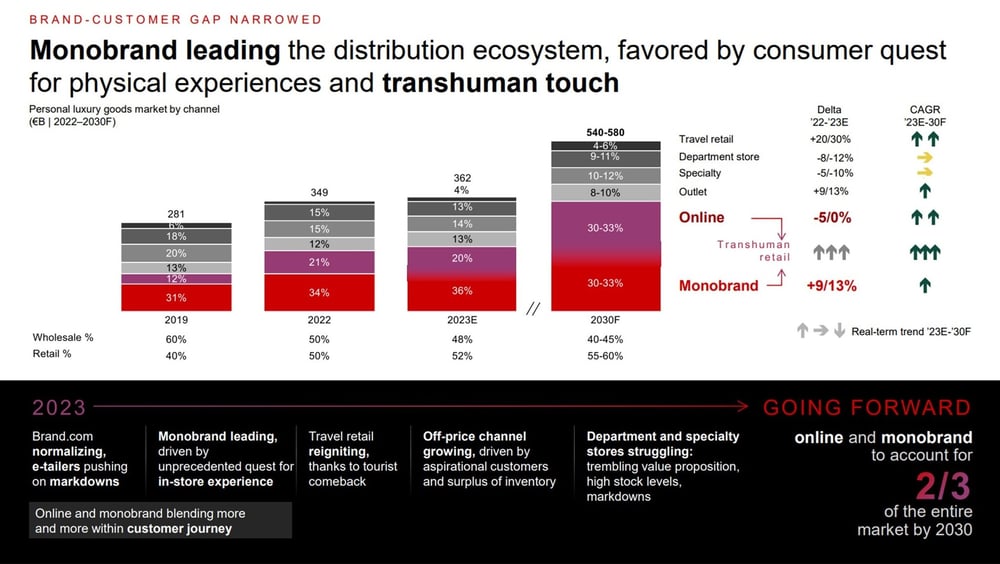

Altagamma, the association of Italy's top luxury labels, is consistently finding that the gap between the sector’s wholesale and retail channels is narrowing, notably threatening the position of multibrand fashion e-tailers, which only two years ago had emerged as the market’s new front-runners. The revenue of physical multibrand stores is forecast to remain stable in 2024, while that of multibrand e-tailers is expected to slump by 1%. Luxury labels’ direct e-tail sales will instead continue to grow, by approximately 4.5%, a lacklustre performance compared to the recent past. Conversely, the analysts interviewed by Altagamma are expecting a 7.5% rise in luxury goods sales via physical monobrand stores.

Sales in luxury labels’ brick-and-mortar and online stores increased significantly in 2022, growing respectively by 26% and 20%. In 2023, the former are continuing to grow, by between 9 and 13%, but the latter are down by 5%. In parallel, sales in department stores, whose value increased by 20% last year, will fall by between 8 and 12% in 2023, according to a study by consulting firm Bain & Co., conducted with Altagamma.

The pandemic and its attendant lockdowns boosted the e-tail channel in 2020 and 2021, notably favouring multibrand platforms, but now that the pandemic is over, there is “a natural acceleration in the performance of physical monobrand stores, driven by renewed socialisation and tourism, and the decline of digital channels, which are plateauing,” said Federica Levato, partner at Bain & Co. and one of the authors of the firm's luxury market report.

E-tail as a digital service?

“The focus is now different. Stores have been transformed, they are becoming a destination, experiential venues for cultural mediation. Since 2019, luxury labels have opened 40 to 45% fewer new stores. They'd rather enlarge existing ones, and exploit them more fully,” added Levato. In this context, e-tail is utilised chiefly as a digital service assisting physical stores, with online and offline solutions becoming increasingly integrated throughout the customer journey.

A renewed enthusiasm for physical stores is especially evident in younger consumers, according to Pier Francesco Nervini, COO for central and northern Europe at duty-free shopping specialist Global Blue. “This year, the duty-free luxury goods market is driven by Millennials and younger consumers. But this is a physical retail phenomenon. We’re seeing a growing inclination for shopping in physical stores,” he said.

In this respect, there are contrasting attitudes among the younger generations’ various age groups. “While more mature individuals, baby boomers, Gen X and Millennial consumers have a preference for aspirational purchases and are keen on excellence, Gen Z consumers, born between 1995 and 2009 - who currently account for 20% of the global luxury market but will account for up to 30% by 2030 - have become the most influential cluster, even though their purchasing power is weakening. And above all, they are keen on experiential shopping,” said Levato. This is why in-store shopping is edging out online purchases.

“The issue is e-tailers’ profitability. Luxury labels would rather push their own e-shops, and have stopped doing business with multibrand e-tailers. [Luxury labels] are also undermining the discounted resale market, which often featured on multibrand platforms, and are gradually cutting down on promotional channels. Suddenly, even though some sites’ sales are still growing, their profitability is plummeting,” said Claudia D’Arpizio, partner at Bain & Co. and co-author of the firm's report.

Tighter cost control

Pure players are bearing the brunt of the renewed enthusiasm for in-person shopping, while at the same time the luxury goods market is slumping. “E-tailers are struggling to grow their revenue and gross merchandise value. Not just because of declining online purchases, but also because many labels are drawing away from this type of wholesale business, or are about to. Fashion e-tailers are struggling because labels want to control prices, and to handle commercial relations directly by means of e-concessions,” Bernstein analyst Luca Solca told FashionNetwork.com. He noted that, even with e-concessions, as in the case of Farfetch, “the problem of attracting customers still remains.”

Solca identified another factor explaining e-tailers’ decline. In the past, the costs of promotional initiatives were borne by traditional retailers. Now, discounts are financed by e-tailers. Suddenly, “running a profitable business is becoming increasingly costly for [e-tailers].” Farfetch, which is about to acquire a 47.5% stake in its Richemont-owned rival YNAP, recorded a revenue slump and a loss in Q2. In the last two years, its stock market capitalisation has plunged. However, some smaller e-tailers, for example Germany-based MyTheresa, are managing to remain buoyant, with sales on the rise and higher gross margin levels.

Pure players will need to revise their business models in order to thrive again on the luxury market, better controlling their costs and focusing less on a promotion-hungry clientèle and more on increasingly flexible purchasing solutions, such as those offered by digital tools.

Copyright © 2023 FashionNetwork.com All rights reserved.